Table of Contents

Remuneration and its planning have always occupied a considerable part of the HR department's workload. It has also recently become a strategic matrix that directly influences the working environment, employee productivity and business results.

In this guide, we look at the various factors to consider when creating a remuneration plan, the steps involved and current trends.

Definition of remuneration in human resources

What is remuneration in human resources? Remuneration is the payment or compensation received for services or employment. This includes a base salary and any bonuses or other economic benefits that an employee or executive receives during employment.

In other words, remuneration is the amount an employee receives in exchange for their services to a private or public organisation under specific conditions.

It's worth highlighting that remuneration includes salary and additional non-monetary benefits given to an employee.

We also need to understand the difference between wages and salaries. Wages are payments made to employees for their services at an hourly or daily rate. On the other hand, a salary is a contractually agreed payment that an employee receives every month or year.

Main statistics on remuneration in Europe

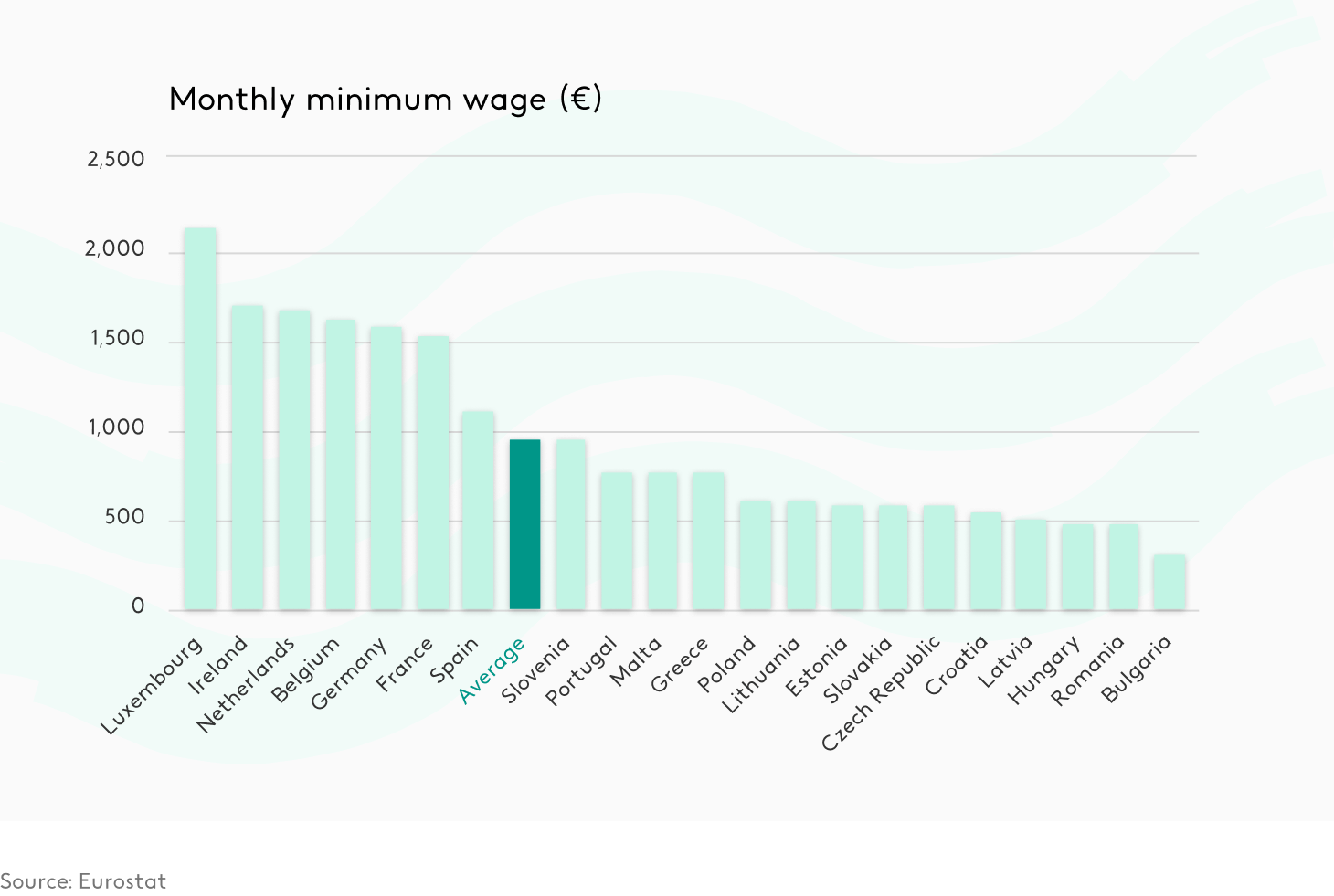

To give you a picture of remuneration in Europe, this article on Wages and labour costs (December 2020) by Eurostat provides some interesting data on current policies and tendencies across the block.

Some highlights include:

The average hourly labour costs in 2019 was €27.7, ranging from six euros in Bulgaria to €44.7 in Denmark.

In 2018, the unadjusted gender pay gap was 14.1% in the EU-27, ranging from 1.4% in Luxembourg to 21.8% of Estonia.

In 2019, in the EU-27, the net annual earnings of an average single working adult without children were €23,600. This ranged from €6,000 in Bulgaria to €32,600 in Luxembourg.

The net annual earnings of an average working couple with two children in the EU-27 were €50,500, ranging from €12,100 in Bulgaria's 290 €94,600 in Luxembourg.

Latvia had the highest share of low-wage earners (defined as workers who earn two-thirds of national average salary or under) with 23.5%. At the same time, those with the lowest percentage included Sweden with 3.6%, France at 8.6% and Italy with 8.5%.

A study of the unadjusted gender pay gap in 2018 revealed that women were paid, on average, 14.1% less than men in the EU 27 as a whole. Germany was among one of the countries with the highest gender pay gaps (20.1%).

Luxembourg and Bulgaria recorded the highest and the lowest average net earnings in 2019, with €57,175 and €6,603 respectively.

The tax wedge on labour costs (the difference between the employer's labour costs and the employee's net take-home pay, including any cash benefits from government welfare programmes) in the EU-27 was 39.5% in 2019. The highest were recorded in Belgium (45.4%) and Germany (45.2%).

In 2020, the European Commission proposed the implementation of a minimum remuneration equal to 60% of the average national salary in each of the 27 countries.

National minimum salaries across Europe vary significantly, Denmark has the highest at €27,341 minimum salary while Bulgaria bottoms the chart with only €2,902 a year.

The UK has the seventh-highest minimum salary in Europe with €18,184 a year.

France ranks tenth, with €14,194 a year.

Germany (13,810) and Spain (11,573€) follow slightly behind.

Some member states do not have a nationally regulated minimum salary, which is traditionally done through collective agreements. Some see the EU Commission's proposal as a threat to their traditional labour systems, meeting it with some resistance.

Remuneration laws across Europe

The European Union regulates basic standards relating to employment and working conditions. These were outlined in the Community Charter of the Fundamental SocialRights of Workers in 1989. However, this charter specifically excludes remuneration and collective bargaining, which are left to each member state to decide.

So, depending on which country your HR department is based, you’ll need to consult and adhere to the laws on remuneration that apply.

But let’s take a look at how some countries approach this area of minimum employee remuneration.

Germany

The German Minimum Wage Act (Mindestlohngesetz) was passed in 2014. Before that, wages were set primarily by trade unions and business groups.

The rate now stands at €9.50 per hour (January 2021), which means pre-taxed wages of €1,647 for people working a standard 40-hour week.

Spain

The Spanish Government published the Royal Decree 231/2020 of 4th February 2020, and which set the minimum gross salary at €950 per month.

This minimum monthly wage has increased steadily from €600 in 2008, until 2019, when it was given a 5.56€ boost of €164 with the introduction of this law.

France

France currently has a national minimum wage of €1,539.40. This is an increase of 1.2% in 2019, but less than the previous year's increase (1.5% from 2018-2019).

This puts France ahead of Germany with a minimum hourly rate of €10.03 per hour, ad is the same for all working adults, regardless of age or experience.

Italy

While there is no official minimum salary in Italy, most Italian workers are covered by minimum wage agreements established through collective bargaining.

A report published by Statista demonstrates that salaries differ considerably by region. The highest earners were based in the Northern Italian region of Lombardy, at €31,400 per year. In contrast, Southern Italy accounted for 17% of the country's low-paid workers (those earning less than two-thirds of the national average).

The United Kingdom

While the UK is no longer part of the EU, its employment laws will still be of interest of many readers. But there is no one-size-fits-all minimum wage in Great Britain, and it depends on employee age and whether they are an apprentice.

The current National Minimum Wage for an employee aged 25 years and over is £8.72, although you can check or calculate the rate for a broader range of age brackets in the UK Government website.

Like an employee's monetary salary, many benefits can be taxable, depending on their type and nature. Whether employee benefits are taxable will depend on the place the benefit is offered (onsite or offsite) and if the entire workforce receives it, or just a selected few.

Among the different types of employee compensation, flexible benefits schemes are becoming increasingly more popular:

The UK Government website, for example, provides tax guidance for employers who offer benefits. And taxes may also vary if these benefits are part of a salary sacrifice scheme.

Companies who offer a flexible benefits system enable their employees to choose which benefits interest them the most. However, such benefits should never fall below a certain threshold. In Spain, flexible benefits can never exceed 30% of the employee’s salary. And in the UK, workers must receive at least the National Minimum Wage in cash, independent of benefits.

Another form of compensation to consider is payment in kind. In most countries, payment in kind cannot exceed 30% of an employee's salary and must not count as part of a minimum wage. Nevertheless, each country has its own specific legislation. For example, there is a maximum daily monetary value on payments in kind for domestic workers in France and Switzerland. Some forms of payment in kind can include company cars and transport subsidies.

Lastly, your remuneration plan must take gender pay gap legislation in your country into account. According to Reuters, however, 13 EU member states still have no pay transparency measures in place. Others vary, such as Germany, who introduced the right to pay information for companies with over 200 employees, and Belgium who plan to combat this through collective bargaining.

The importance of remuneration human resources

Remuneration plays an important part in human resources because it influences many aspects: the relationship between employee and employer, talent attraction and retention, commitment, and the results achieved.

- Your employees' primary source of income is their salary, so it's vitally important to them. So your company must be able to guarantee conditions that are attractive enough to attract and retain talent.

- Companies spend a lot of money hiring new employees (considering their base salary and tax), so payroll is one of the largest expenses in an organisation’s budget. Even so, there are several ways to reduce labour costs in your company.

- Employee well-being is directly related to their productivity and motivation. Well-paid professionals perform better. So we could say that there is a direct relationship between investments in salary and business results.

- Commitment is also closely linked to the remuneration an employee receives. If your employees are paid a competitive salary and have growth prospects within the organisation, they're more likely to stay in the company and refuse other potential job offers.

- There is also evidence that an attractive pay and benefits programme is a powerful tool for strengthening employer branding and attracting new talent to the company. While salary is important, employees are placing increasing value on flexible working, childcare vouchers, etc.

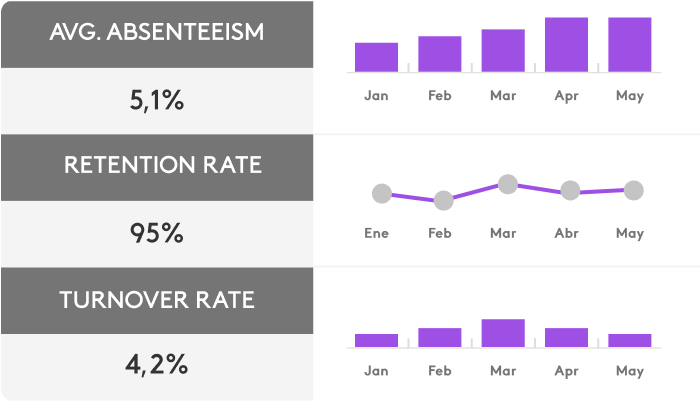

Relationship between performance reviews and pay

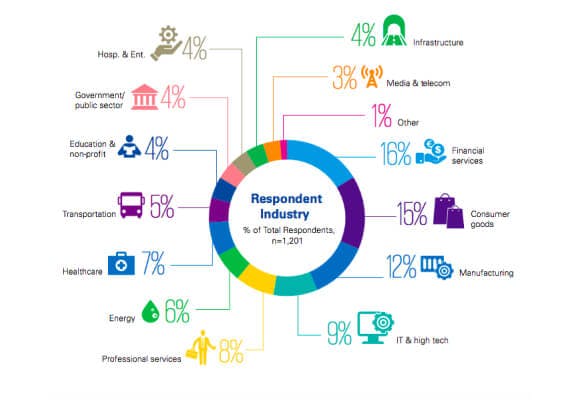

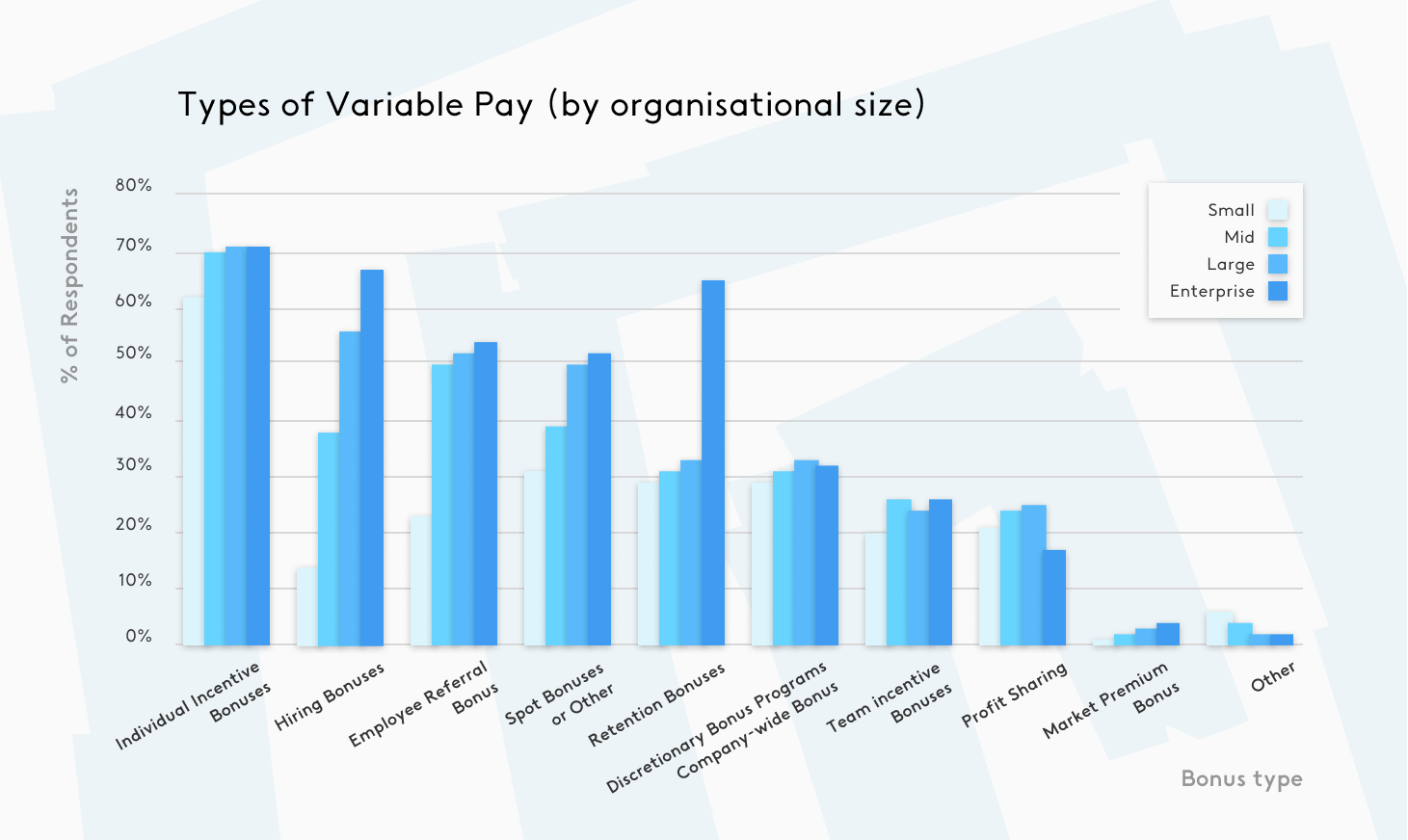

According to Payscale’s 2018 Compensation Best Practices Report (CBPR), 71% of organisations said they offer some types of variable pay. Variable pay is an umbrella term that covers two kinds of rewards linked to performance objectives. Firstly, bonuses may or may not be tied to a performance objective and are usually retrospective (based on past results).

The second kind is the "incentive", associated with a specific plan that focuses on future performance. These rewards can be distributed among the workforce equally or based on individual performance. Qualitative metrics linked to objectives are often used for performance reviews to determine merit-based salary increases. Some frequently used qualitative criteria include, for example, the success of specific projects, customer satisfaction ratings, and teamwork.

Source: Payscale

Quantitative metrics linked to profits such as increased turnover or sales, for example, can also be used to determine these rewards.

So, as we can see, the performance review and remuneration are closely linked, and usually depend on each other.

Types of employee compensation

There are three mainremuneration systems used in companiesthroughout Europe. A remuneration plan may usually combine all three, according to the needs and objectives of the company.

We look into these below:

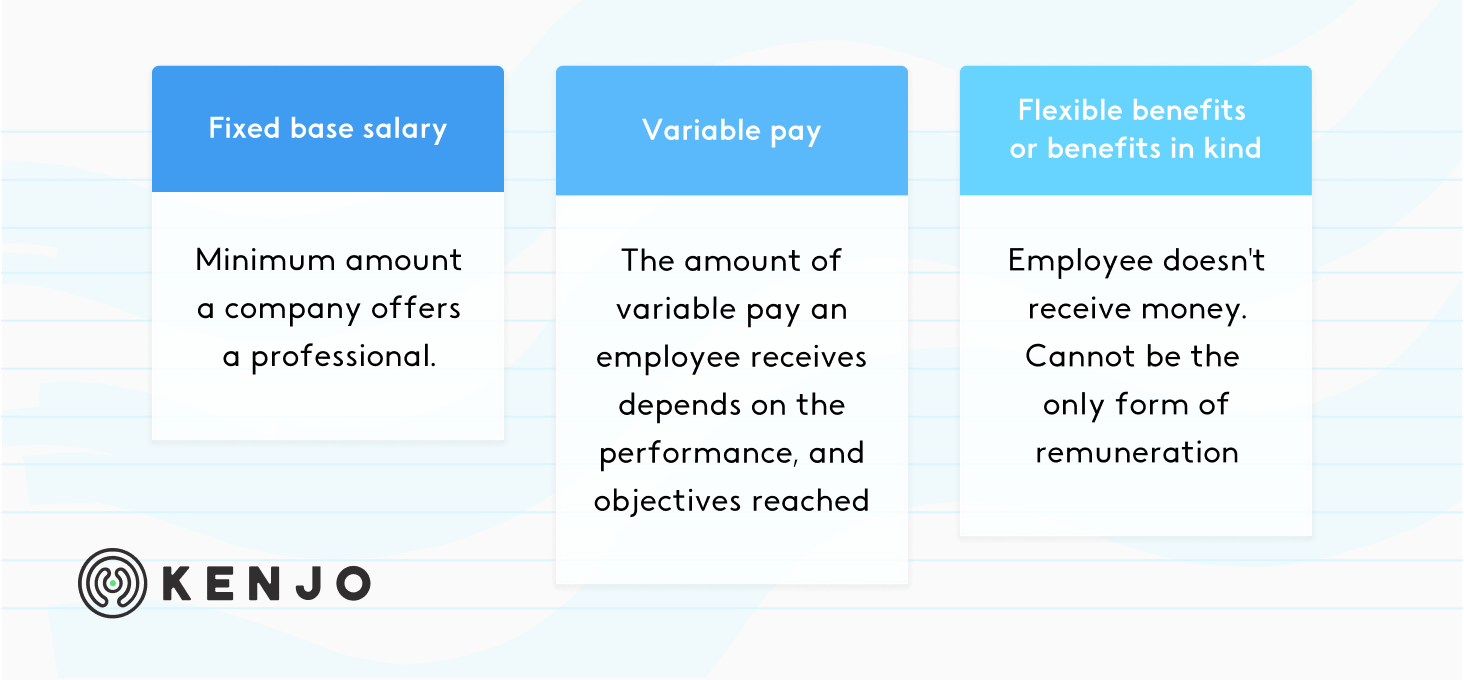

Fixed base salary

Fixed base salary is the minimum amount a company offers a professional for their services and is agreed in the contract. The amount will vary depending on the role, salary range, and hours worked.

In most countries, it is usually divided into 12 monthly payments. The employee receives this on the same day every month, regardless of the results achieved during that period. This model offers employees stability because everyone knows what they will receive every month.

Variable pay

In contrast to a fixed salary, the amount of variable pay an employee receives depends on the performance, and the objectives reached. This depends entirely on their performance and can change from month to month. For that reason, it is known as variable pay.

This form of remuneration aims to motivate and encourage employees to be the best they can be. It's a win-win situation: the company sells or produces more, and the employee gets more money at the end of the month.

A variable pay system can only work if you establish a clear plan with objectives and a system for measuring them. There are different ways of paying employee commission to help you ensure this system runs smoothly.

Incentives should not be confused with benefits, which are another form of employee compensation. You can get a greater understanding of the differences between benefits and incentives in our blog.

Flexible benefits or benefits in kind

Lastly, we have flexible benefits, which can also include benefits in kind. The main difference here is that the employee doesn't receive money, but products or services in exchange for their services.

In this context, there are various options: company car, health insurance, restaurant and childcare vouchers, pension plans or transport subsidies. This kind of remuneration is often extremely important for the employee because it also comes with attractive tax benefits.

It's important to emphasise that this kind of payment cannot be the only form of remuneration in the UK, and they must be combined with a fixed or variable salary. Employees must at least pay their employees the National Minimum Wage. It must, therefore, be part of a package along with one of the previous two options.

Internal factors to consider when establishing a pay policy

While any pay plan is based on generalised criteria, it’s important to pay attention to certain aspects and adapt it to the organisation's context and specific needs as much as possible.

Accurately define job roles

One fundamental aspect of any pay policy is to correctly define the skills, knowledge, experience and responsibilities of each role in the company and their various ranks.

This is the only way to organise and categorise your workforce into groups and establish common criteria between them to ensure coherence.

Salary ranges

Salary ranges are another aspect you need to take into account: They establish a minimum and maximum salary for each of the different levels of professional groups that make up the company. Salary ranges ensure:

- Salaries will be fairer.

- Bias is minimised.

- Employee motivation and commitment increases.

- The company optimises its labour costs.

Salary ranges are also extremely useful when calculating salary increases for an employee.

Internal equality, whether in terms of gender or between employees doing the same jobs

On the subject of salary ranges, your company’s pay plan also plays an important part in promoting equal pay within the company. In other words, two people in the same range are paid the same.

Employee performance

As we have observed, employee performance is crucial to any results-based incentive plan. It's vital to conduct regular performance reviews and establish clear criteria within the company.

Rewarding employees who are putting more effort and generating positive results for the company is also important.

Company location

You should also take the company location into account when establishing salaries. The cost of living in a big city is not the same as that of a small town, where employees can walk to the office without spending money on transport.

External factors to consider when establishing a pay policy

There are also external factors that directly influence the company's pay policy:

Job market

Pay attention to the state of the job market and the salaries that your competition is offering. These serve as a reference upon which to base your plan, and better position the offer and conditions.

Employment law

As you know, changes to employment laws could affect your company's remuneration—increases in the CPI or minimum interprofessional salary, contractual changes, etc.

You also have to consider the different collective agreements in each sector that must be complied with, and that can set salary ranges for the different roles in the company.

Economy

Your country's economy is another strong external influence that can affect your pay policy. In times of crisis where forecasts are pessimistic, you may need to create more prudent pay policies. On the other hand, if the economy is buoyant, you can offer better conditions for your employees.

Steps for establishing a compensation plan for your workforce

We recommend that you follow a series of steps to create a coherent and objective remuneration plan.

Read our tips on how to design a pay policy:

1. Outline job descriptions

All companies are made up of different types of professionals because any successful business activity needs a mix of different profiles. Having an organogram helps you easily visualise the different groups or categories in a company and create detailed descriptions for each one. Include information such as the level of responsibility, training and qualifications, functions, etc. This will make it so much easier when evaluating the salaries associated with each role.

2. Establish salary ranges

Once you've completed the first step, set a salary range for each job description. This ensures that you have a starting salary for each post, a midway point, and a maximum that can be reached when an employee performs exceptionally. At this point, we are only talking about limits for each role and not about specific people.

3. Review current salaries in your company

The next step is to look over salaries your employees are currently receiving and compare them with salary ranges you've just established. The most important thing right now is to determine the wage dispersion and if two people doing the same job are receiving disparately different amounts.

4. Adjust the salaries

Ultimately, it's time to take action. If you have identified salary inequalities or a high wage dispersion level, you need to make some adjustments. This is the most complicated part, but creating an attractive offer can mean combining different kinds of remuneration with social benefits, work-life balance or professional growth.

Discover how our template helps you adjust your employees’ salaries according to their performance and many other important factors.

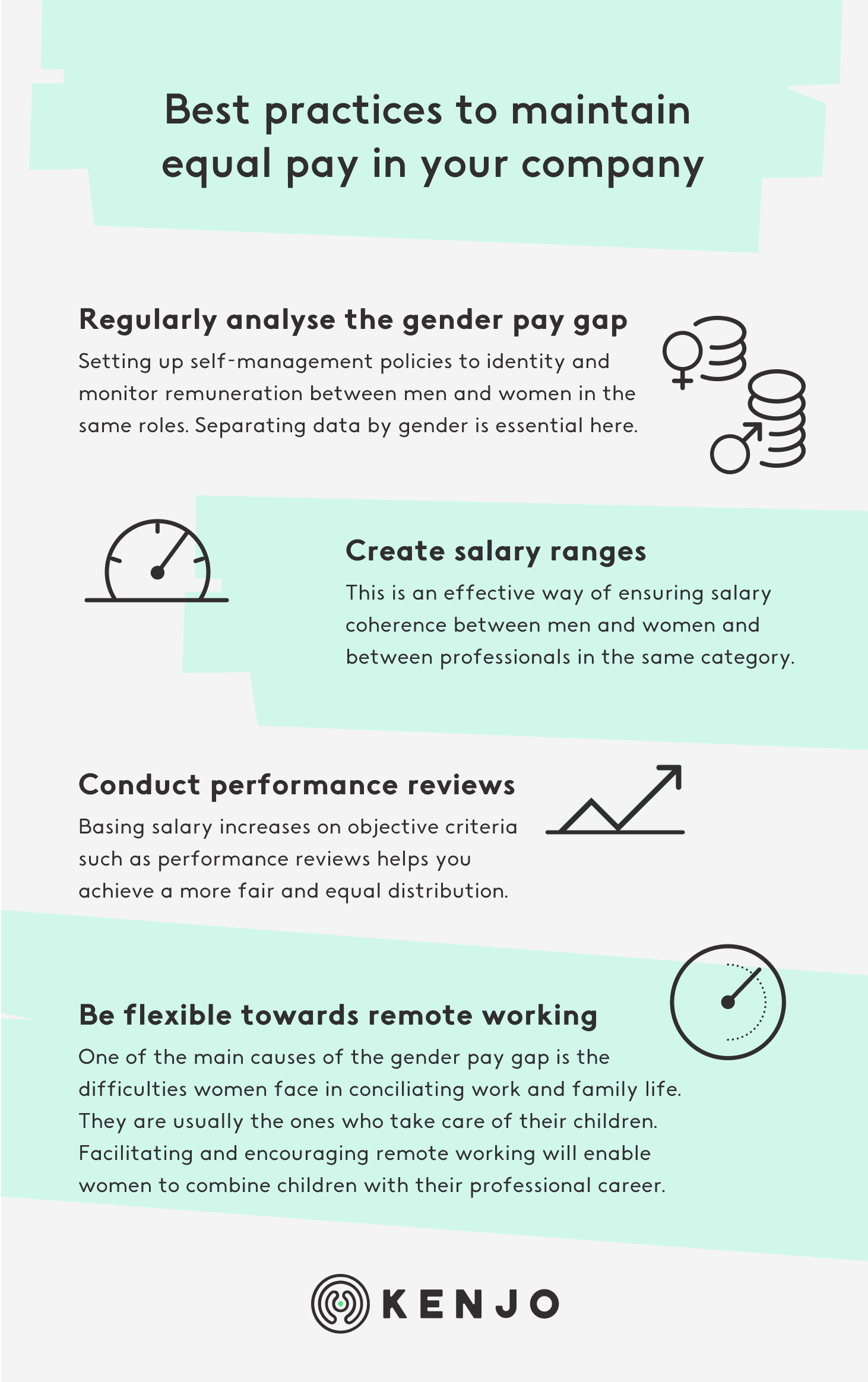

Best practices to maintain equal pay in your company

Closing thegender pay gap, or the differences in salary between men and women has been a pressing issue for some years. In Europe, for example, women earn an average of almost 15% less per hour than men.

To combat this, many governments oblige companies to create equality plans. These involve a series of measures to achieve equal opportunities and treatment between men and women and eliminate gender discrimination.

The UK Government requires all companies with over 250 employees to report specific data about men and women's salaries in their company. This obliges these companies to publish their gender pay gap data on their public-facing website, and report their data to the Government.

In addition to these obligatory requirements, companies should also adopt certain best practices to help them reduce unequal pay between men and women.

New trends in remuneration

Remuneration plans are living documents that meet the changing needs of every company's workforce. This means that new trends emerge over time. Businesses must use them as a reference or inspiration to choose the ones that best suit their needs and therefore create plans accordingly.

1. Pay policy reviews are the norm

Around 45% of companies prioritise pay policy reviews. Without a doubt, they are becoming more and more important, so keeping them up-to-date to meet changing business needs is vital.

2. Variable pay is on the rise

Companies are placing more importance on variable pay in the short term, which increased from 20% in 2018 to 42% in 2019. In contrast, longer-term variable pay decreased from 73% to 37%. In general, this is because companies prefer to reward employees faster to prevent them from becoming demotivated.

3. Objectives: the principal criteria

Objectives are the most widely-used criteria for measuring employee efforts and rewarding them with monetary or non-monetary benefits. The majority of companies use objectives based on profits (85%) or project success (6%).

OKRs (Objective and Key Results) -a system for setting objectives and measuring results that enables you to measure progress - is one of the most popular models for establishing objectives. For example:

Objective: Increase sales.

Key result: double monthly sales leads.

Ideally, each employee would have their own OKRs which are reviewed in regular appraisals.

Goals and OKR software like Kenjo help you to control and monitor them easily. It's an excellent way of integrating them into the same platform to ensure they make sense and are aligned with company strategy.

4. Emotional salary is also important

Emotional salary, or rather, the intangible value a company can offer its employees, has been a hot topic recently. This should, and must, for part of your remuneration strategy. For example, we're talking about creating a tension-free work climate, encouraging cooperation between teammates, giving constructive feedback, providing leisure and relaxation facilities within offices, etc.

5. Flexibility infiltrates remuneration plans

Employees are becoming increasingly diverse, as are their needs and interests. So it always better to create flexible remuneration plans that can adapt to each individual. This trend also relates to the way employees are paid. Many believe in a future with personalised payment programmes within each company.

6. Remuneration harnesses technology

Companies will continue to invest in technology that helps them simplify and automate HR capital management processes, including remuneration. Reporting and analytics will help you better adjust salaries, identify employees interests, make the best use of company budgets and create personalised experiences.

Performance review software will also be essential to assess employee skills and get objective data to determine possible salary increases and results-based commissions. Merit is one of the most important remuneration criteria, so it's vital to have the right tools to measure it correctly.